Tin tức VINACAS AND SOME TRADE ASOCIATIONS. Proposing the Prime Minister to ussue travel permits for interpriset

VINACAS AND SOME TRADE ASOCIATIONS. Proposing the Prime Minister to ussue travel permits for interpriset

VINACAS AND SOME TRADE ASOCIATIONS. Proposing the Prime Minister to ussue travel permits for interpriset

In recent days, On August 25, 2021, Faced with the feedback of enterprises having difficulty in issuing travel permits, so there is a risk of not being able to pass export procedures; causing production and export activities of enterprises to be stagnated, and at the same time face huge losses such as increased demurrage fee, goods that are stored for a long time will be reduced in quality, liability for compensation due to contract violations on delivery schedule for international customers …The Vietnam Cashew Association has joined with some trade associations such as: Vietnam Pepper Association, Vietnam Rubber Association, Vietnam Fruit and Vegetable Association, Vietnam Coffee and Cocoa Association,Vietnam Cotton Association, Ho Chi Minh City Fine Arts and Woodworking Association have just sent an official dispatch to Prime Minister Pham Minh Chinh, Deputy Prime Minister Le Van Thanh, Ministers of related ministries, Chairman of Ho Chi Minh City People's Committee and Director of Ho Chi Minh City Department of Industry and Trade on the issuance of travel permits for their members to perform urgent tasks during the time of social distancing.

The Vietnam Cashew Association and the trade associations recommend: 1. There should be specific and unified guidelines on a contact point in issuing travel permits for manufacturing and exporting enterprises. At the same time, more officials in charge of handling documents for businesses should be mobilized. 2. Travel permits should be issued in soft copy and sent via email, so that the businesses can conveniently pass through the checkpoints to reach the head office of the DIT for stamping. 3. The industry associations will be the focal point and responsible for making a list of enterprises that are members of the associations in need of applying for a travel permit and sending it directly to the city and provincial DITs so that to reduce the overloading on the agencies at the same time enhance the role and responsibility of the associations in the prevention of the Covid-19 epidemic. The heads of member enterprises are responsible for the registration list and commit to strictly manage the list of employees who are granted travel permits. For businesses that are not members of the Association, the procedures for applying for a travel permit will be carried out at the Department of Industry and Trade and local authorities.

More details on this issue can be found in some newspapers, following the links: https://nongnghiep.vn/kien-nghi-thu-tuong-viec-giay-di-duong-gay-kho-cho-xuat-khau-nong-lam-san-d301006.html Chóng mặt vì xin cấp giấy đi đường, nhiều hiệp hội kêu cứu Thủ tướn - Tu i T n ine tuoit e vn TP. Hồ Chí Minh: 8 hiệp hội ngành hàng kiến nghị cấp giấy đi đường cho doanh nghiệp trong thời gian giãn cách xã hội (congthuong.vn)

On August 18, 2021, the Ministry of Industry and Trade issued Decision No. 1974/QĐ-BCT "Approving and announcing the list of "Reliable Exporters" in 2020"

According to this decision, there are 315 enterprises in the country that meet the selection criteria. The Cashew industry has 18 enterprises; As follows:

O.N. COMPANY'S NAME SELECTION ORGANIZATION

1 Long An Export Processing Joint Stock Company Department of Industry and Trade of Long An province

2 Long Son Joint Stock Company Vietnam Cashew Association

3 Hoang Son 1 Joint Stock Company Department of Industry and Trade of Bình Phước province

4 Thao Nguyen Ltd. Co Department of Industry and Trade of Bà Rịa - Vũng Tầu province

5 Cao Phat Ltd. Co Department of Industry and Trade of Bà Rịa - Vũng Tầu province

6 Minh Huy Ltd. Co Department of Industry and Trade of Đồng Nai province

7 Dakao Ltd. Co Vietnam Cashew Association

8 Long Sơn Inter Foods Ltd. Co Vietnam Cashew Association

9 Visimex Group Joint Stock Company Vietnam Cashew Association

10 Hanoi Import-Export Service Production Joint Stock Company Vietnam Cashew Association

11 Intimex Group Joint Stock Company Department of Industry and Trade of Ho Chi Minh city

12 Vietnam Haíìmex Group Joint Stock Company Vietnam Cashew Association

13 Vietnam Haíìmex Group Joint Stock Company - Binh Phuoc Branch Vietnam Cashew Association

14 Hanoi Trade Joint Stock Corporation Department of Industry and Trade of Hanoi city

15 Bimico Ltd. Co Vietnam Cashew Association

16 Richcom Ltd. Co Vietnam Cashew Association

17 Phu Thuy Ltd. Co Vietnam Cashew Association

18 Prosi Thang Long Joint Stock Company Vietnam Cashew Association

The Information Council of the Vietnam Cashew Association warmly congratulates 18 enterprises of the cashew industry that have been recognized as "Reliable Exporters" in 2020; Wishing the company's leaders, officers and employees healthy and happy; make more efforts for enterprise to thrive and sustainably; make a worthy contribution to the development of the Vietnam cashew industry and the country.

1 - RAW CASHEW MARKET

Raw cashews are being transacted at the following prices (C&F HCM):

| Origin | Outturn (Lb) |

Nut count | Price (USD/mt) |

| Guinea Bissau | 53 | 220 | 1550 - 1580 |

| Indonesia | 53 | 200 | 1555 - 1585 |

According to the Vinacas office, the data of raw cashew imported to the end of

July 2021 compiled from the official source of the General Department of Customs is

as follows:

1.1. Điều thô/ Raw cashew nut in shells (HS code: 08013100

| Tháng/ Month | Lượng NK/ Volume (Mt) | So cùng kỳ 2020 (%) | Kim ngạch NK/ Turnover (USD) | So cùng kỳ (%) | Giá NK BQ/ Price (USD) | So cùng kỳ (%) |

| 1 | 139,944.75 | 113.35% | 184,209,318.94 | 94.19% | 1,316.30 | -8.98% |

| 2 | 126,904.44 | 130.87% | 180,640,535.21 | 126.79% | 1,423.44 | -1.77% |

| 3 | 473,314.65 | 446.45% | 741,832,576.62 | 552.87% | 1,567.31 | 19.47% |

| 4 | 459,031.42 | 330.80% | 728,594,204.58 | 453.01% | 1,587.24 | 28.37% |

| 5 | 294,964.84 | 151.14% | 401,151,740.11 | 187.33% | 1,360.00 | 14.41% |

| 6 | 309,472.79 | 52.13% | 393,435,852.39 | 77.29% | 1,271.31 | 16.54% |

| 7 | 348,723.31 | 61.39% | 449,378,022.70 | 103.59% | 1,288.64 | 26.15% |

| T.cộng | 2,152,356.20 | 153.01% | 3,079,242,250.56 | 207.27% | 1,402.03 | 12.23% |

| K. hoạch năm (*) | 1,450,000.00 | -16.47% | 1,667,500,000.00 | -14.59% | 1,150.00 | -2.44% |

| So với K.hoạch | đạt 148.44 % so với kế hoạch năm 2021 |

184.66 % | 121.92 % |

1.2. Điều nhân (vỏ lụa, nhân trắng)/ Raw cashew kernel in testa and white kernels (HS code: 08013200)

| Tháng/ Month | Lượng NK/ Volume (Mt) | So cùng kỳ 2020 | Kim ngạch NK/ Turnover | So cùng kỳ (%) | Giá NK BQ/ Price (USD) | So cùng kỳ (%) |

| 1 | 7,401.55 | 111.62% | 44,411,255.24 | 112.27% | 6,000.26 | 0.31% |

| 2 | 3,302.69 | -29.51% | 20,581,363.18 | -27.34% | 6,231.70 | 3.09% |

| 3 | 7,881.48 | 24.35% | 49,284,260.52 | 19.13% | 6,253.17 | -4.20% |

| 4 | 7,045.78 | 56.09% | 44,865,724.41 | 60.94% | 6,367.74 | 3.11% |

| 5 | 6,767.92 | 88.91% | 41,876,104.97 | 100.92% | 6,187.44 | 6.36% |

| 6 | 10,005.74 | 130.46% | 62,164,381.69 | 153.82% | 6,212.87 | 10.14% |

| 7 | 9,534.94 | 114.23% | 62,556,544.11 | 137.56% | 6,560.77 | 10.89% |

| T.cộng | 51,940.10 | 65.36% | 325,739,634.13 | 71.30% | 6,259.14 | 4.06% |

2 - CASHEW KERNEL MARKET

Transaction prices are recorded as follows (FOB HCM):

| Types of processors | W180 (USD/Lb) | W210 (USD/Lb) | W240 (USD/Lb) | W320 (USD/Lb) W450 | W450 (USD/Lb) | WS (USD/Lb) | LP (USD/Lb) |

| BRC & Smeta | 4.10 - 4.20 | 3.95 - 4.0 | 3.70 - 3.85 | 3.45 – 3.65 | 3.25 - 3.35 | 2.55 – 2.70 | 2.00-2.20 |

| BRC | 3.95 – 4.00 | 3.85 – 3.90 | 3.50 - 3.65 | 3.40– 3.50 | 3.00 - 3.20 | 2.35 - 2.40 | 1.90-2.00 |

| HACCP | 3.80 - 3.90 | 3.70 - 3.80 | 3.35 - 3.40 | 3.10 - 3.15 | 2.90 - 2.95 | 2.20 - 2.30 | 1.80-1.90 |

According to the Vinacas office, the data of cashew kernels exported to the end of July 2021 compiled from the official source of the General Department of Customs is as follows:

1. Số lượng, kim ngạch và giá xuất khẩu. (Export volume, turnover and price).

| Tháng (Month) | Lượng XK/ Volume (Mt) | So cùng kỳ 2020 (%) | Kim ngạch XK/ Turnover (USD) | So cùng kỳ (%) | Giá XK BQ/ Price (USD) | So cùng kỳ (%) |

| 1 | 47,854 | 82.32% | 273,025,947 | 51.25% | 5,705 | -17.04% |

| 2 | 22,080 | -20.79% | 122,100,185 | -37.49% | 5,530 | -21.09% |

| 3 | 47,443 | 0.42% | 122,100,185 | -19.14% | 5,624 | -19.48% |

| 4 | 51,195 | 11.50% | 293,269,058 | -1.99% | 5,728 | -12.10% |

| 5 | 54,997 | 28.66% | 327,572,232 | 25.24% | 5,956 | -2.65% |

| 6 | 62,515 | 47.41% | 385,852,173 | 48.34% | 6,172 | 0.63% |

| 7 | 59,061 | 41.59% | 378,157,310 | 56.68% | 6,403 | 10.65% |

| T.cộng | 345,145 | 25.90% | 2,046,779,882 | 15.77% | 5,874 | -9.48% |

| K.hoạch XK (*) | 525,000 | 0.69% | 3,600,000,000 | 12.14% | 6,857 | 10.31% |

| So với K.hoạch | đạt 65.74 % so với kế hoạch năm 2021 |

56.85 % | 85.66 % |

| So với K.hoạch | đạt 65.74 % so với kế hoạch năm 2021 |

56.85 % | 85.66 % |

3 - EVALUATION, RECOMMENDATIONS

a. Raw cashew market

The raw cashew market is still quiet. Some raw cashew trading companies are moving their new offers to India instead for Vietnam because they think that: It is difficult to sell at high prices to Vietnam during this period.

Due to not being able to get money to sell cashew kernels, many factories do not have a source of USD to pay for the raw cashews they bought that have arrived at the port; Therefore, the demurrage

b. Cashew kernel market

he cashew kernel market has had customers buying back, but it is still slow; price no increase; mainly demand comes from the US.

c. Recommendation

From now until the end of September 15, 2021; due to the implementation of strict regulations on the prevention of the COVID-19 epidemic, the travel, import and export of enterprises will face many difficulties; It can be difficult to receive the original bill of lading and other shipping documents. Processors are trying to maintain production to fulfill the contract; also to have money to pay for imported raw cashew, continue to the next production cycle.

In the current epidemic situation, which is extremely complicated and unpredictable; Processors should not buy raw cashews at a high price and do not keep a large inventory unless there is a contract and profit.

1 .MARKET COMMENTARY

The international cashew kernel market remained on a slightly uptrend in August after rising sharply at the end of July Up to this point, the raw cashew stocks in Africa being depleted early but global demand

remaining strong, Therefore demand is expected to be very strong at the start of the next cashew season. Trade in raw cashew nuts is

extremely rare because the last volumes available in West Africa

are already under export commitments and cashew exporters from East Africa and Indonesia are not yet positioned in terms of price

or start date of exports.

2 .THE INTERNATIONAL RAW CASHEW MARKET

Côte d'Ivoire

he cashew market is calm. Stocks are very scarce but demand is still present. Some traders have small quantities of bad qualities which they trade with buyers at wholesale prices around 450 FCFA /kg. Despite disappointing yields per tree this year, the Ivorian harvest has further increased and should ultimately approach 950,000 tonnes.

Guinea Bissau

The Commerce Ministry had recorded an inflow of 219,000 MT of raw

cashews into Bissau city and will export more than 220,000 tonnes this

year, which is significantly more than in past seasons.Adding in informal flows through the land borders with Senegal and Guinea, the country's production has probably exceeded 250,000 MT this year. Which is a record in itself.

Burkina Faso

he raw cashew market is over. Stocks are almost nonexistent in warehouses. Buyers withdrew from the cashew market due to the unavailability of nuts

The rainfall has been good so far and the cashew trees have a good appearance, which allows us to hope for a good harvest in 2022.

Guinea

he raw cashew market is generally calm.

The marketing campaign is over and commercial transactions are rare. In the main production regions, there is a total depletion of raw cashew stocks

The weather conditions are generally optimal and should allow a good harvest next year.

Mozambique

looms are starting to become widespread in the provinces of Cabo Delgado, Nampula and Zambezia.

According to the growers, the 2021 harvest is expected to be significantly better than that of 2020 due to better rainfall during the rainy season and small rains which have continued since then helping to maintain good soil moisture levels.

Producers also expect an earlier harvest than last year with the first nuts available from late September/early October in some production area

3. THE INTERNATIONAL CASHEW KERNEL MARKET

Vietnam

India

ince Export markets are inching up slowly due to shipments issues from Vietnam as there was shortage of container, high ocean freights and corona lockdown.

VINACAS office gathered from foreign newspapers

CASHEW MARKET ANALYSIS

(The opinion of the analyst by Pierre RICAU - N’KALÔ August 18th , 2021)

ôte d’Ivoi e this yea once again broke a production record and is slowly but surely approaching production of 1 million metric tons.

At the same time, production was rather good in the West zone (Guinea-Bissau, Senegal, Gambia) where it should exceed 300,000 Metric Tons after years of production around 250,000 MT for the 3 countries.

In the end, West African production could therefore be up slightly compared to last year. The growth in productive areas more than offset the decline in yields per tree in many areas.

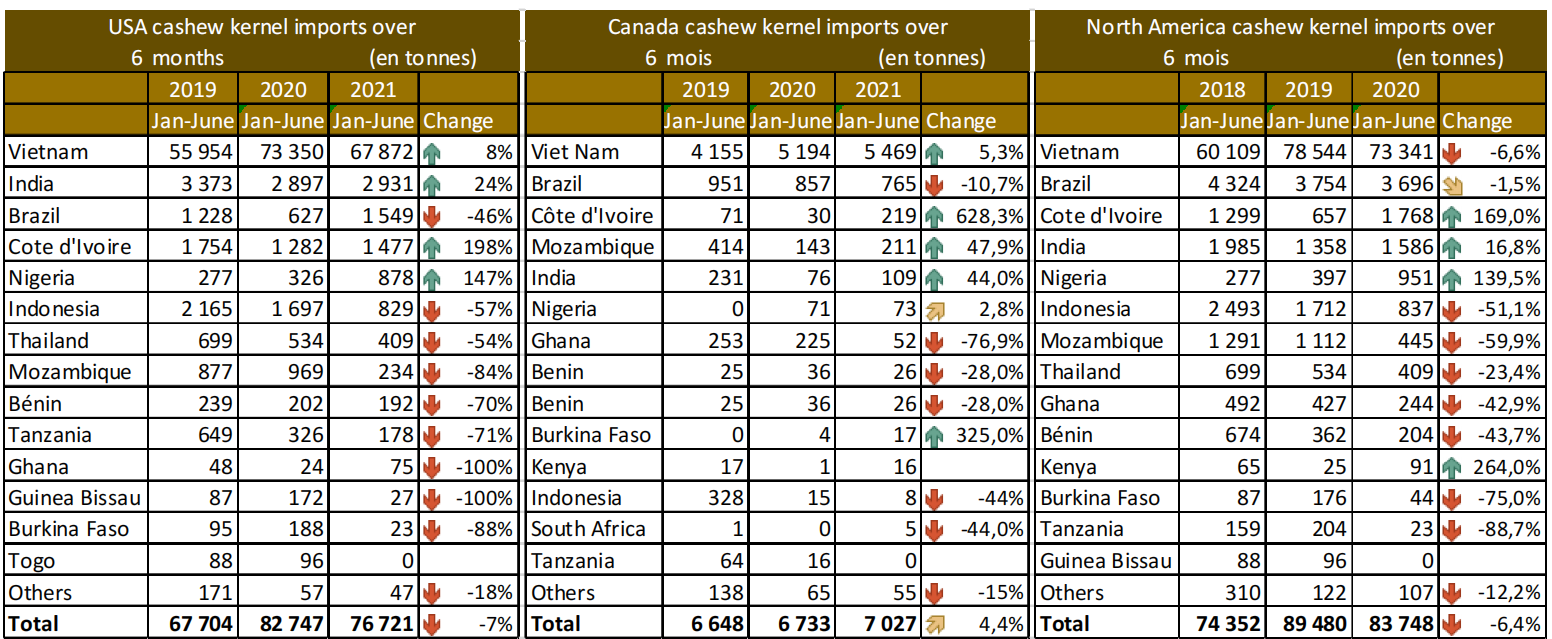

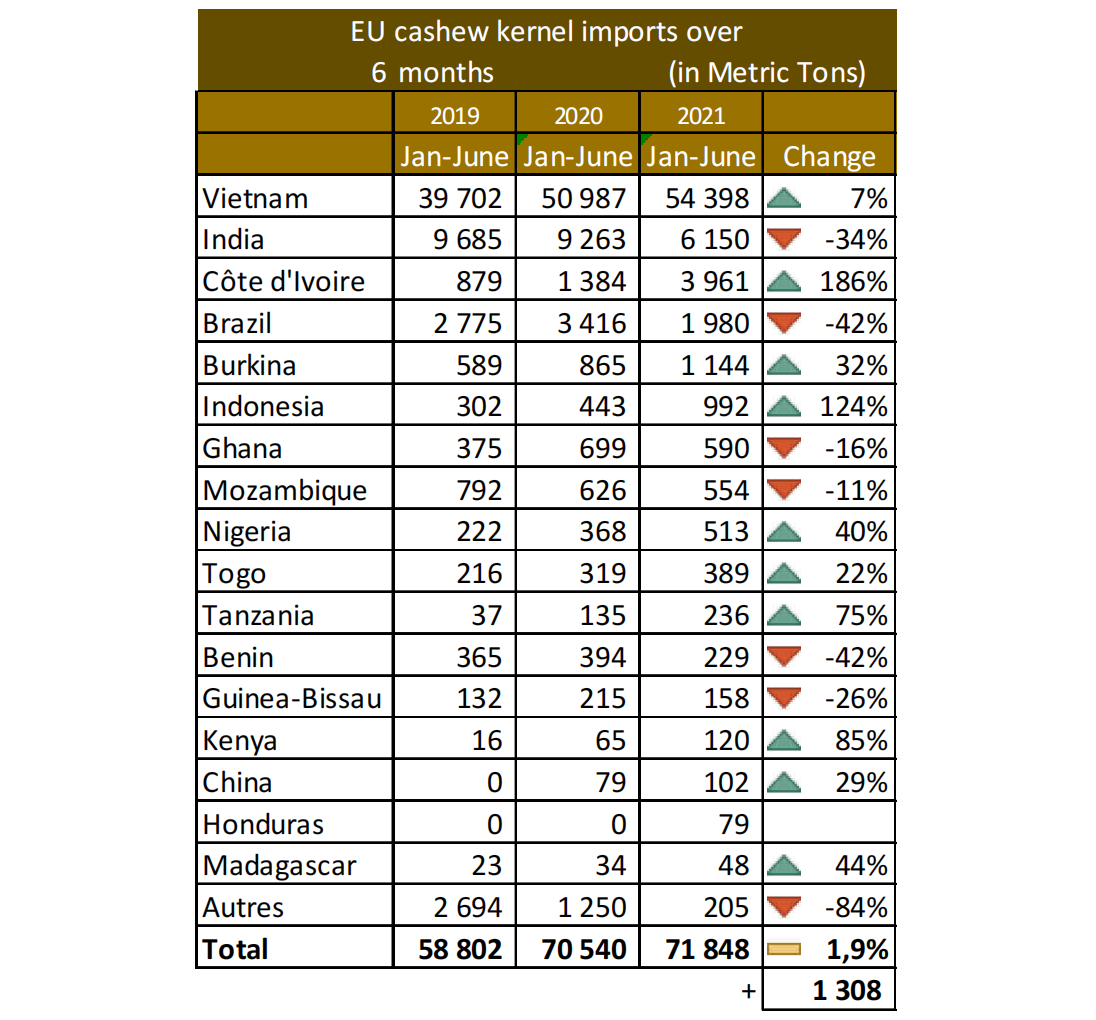

At the same time, West African local processing continues to experience significant growth, as can be seen in import statistics from North America and the European Union, the two largest import markets in which He West Africa continues to gain market share, led by Côte d'Ivoire and Nigeria.

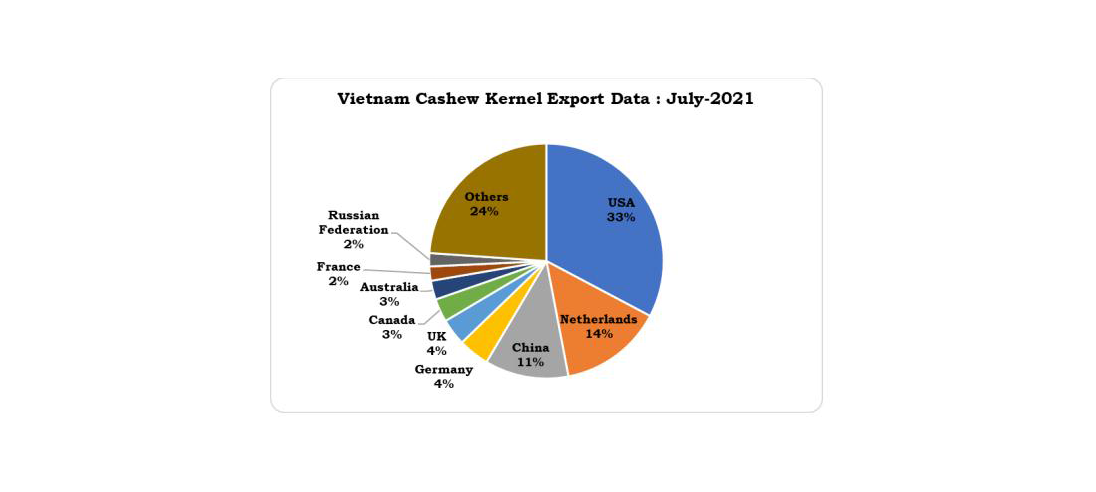

As can be seen below, the North American market experienced a slight drop in its imports in the first half of 2021compared to the first half of 2020. Despite this, Côte d'Ivoire and Nigeria gained significant market shares.

On the European market, which has experienced moderate growth in imports, market share gains are very important for Côte d'Ivoire.

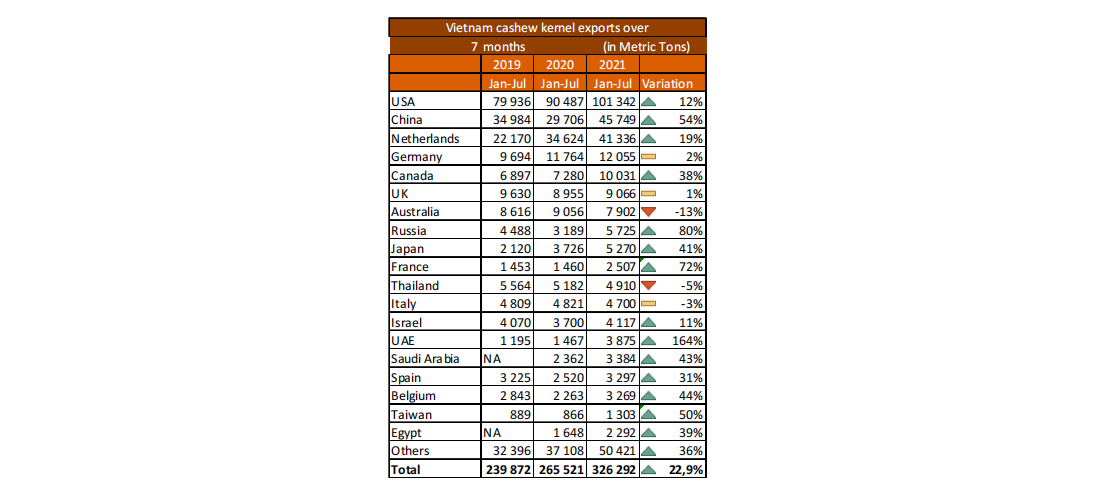

It should also be noted that trade statistics for the first 7 months of the year in Vietnam indicate good growth in demand, including on the North American market. Declines in imports from Western countries therefore seem to correspond more to logistical slowdowns (stocks blocked at sea and in ports) than to a drop in orders.

Bình luận